Global financial markets have been turned upside down this year by President Donald Trump’s burgeoning trade war. Markets are not in full panic, but the double-digit declines in major U.S. stock indexes are testing nerves.U.S. markets had been on a two-year tear coming into 2025, though many believed that stock prices had become overinflated. Trump’s trade war pushed that sentiment into hyperdrive. The S&P 500 has tumbled more than 12%, and U.S. markets are being outpaced in Europe, Asia, and just about everywhere else.Trading in traditional “safe havens” like U.S. Treasurys and the dollar has become erratic and unpredictable. On Monday, the dollar struck a three-year low and U.S. Treasury yields have been soaring. Typically, yields would fall as investors seek a safe place to park their money. U.S. Treasurys no longer appear to provide the shelter they once did.Only gold, a commodity traded internationally, has maintained its reputation as …

How mortgage fraud costs Canadians and fuels organized crime

What I, a Muslim, did not know about Israel: Mohammed Rizwan in the National Post

How stocks, bonds, other markets have fared so far in 2025 [Video]

Categories

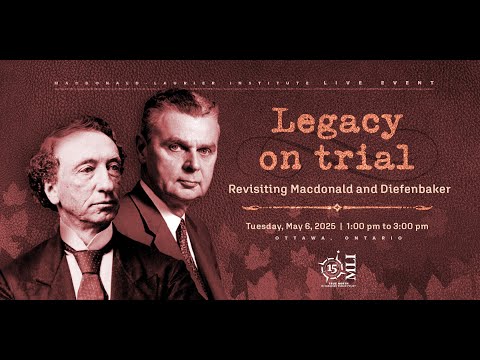

Legacy on Trial: Revisiting Macdonald and Diefenbaker

Should Canada be all in on Trump’s ‘Golden Dome’ defence system?: Richard Shimooka in The Hub

![How stocks, bonds, other markets have fared so far in 2025 [Video]](https://canadanewsvideo.com/wp-content/uploads/2025/04/mp_755773_0_gettyimages22102789226806bbb6b0bbdjpg.jpg)

![YouTube [Video]](https://canadanewsvideo.com/wp-content/uploads/2025/06/mp_777492_0_0jpg.jpg)

![YouTube [Video]](https://canadanewsvideo.com/wp-content/uploads/2025/06/mp_777495_0_0jpg.jpg)

![Wildfire season on track to be 2nd-worst on record in Canada [Video]](https://canadanewsvideo.com/wp-content/uploads/2025/06/mp_777483_0_9OYubkCpscaledjpg.jpg)

![Squamish wildfire balloons to 59.5 hectares, containment lines holding - BC [Video]](https://canadanewsvideo.com/wp-content/uploads/2025/06/mp_777471_0_IMG3277jpeg.jpg)